Investment Portfolio Optimizer

The Portfolio Optimizer is a sophisticated analytical tool developed by QuantyPhi’s balance sheet optimization experts to help credit unions make informed investment decisions. It combines QuantyPhi’s two pillars of portfolio management with advanced analytical functionality to automate your investment decision making process. QuantyPhi’s two pillars of sound investment portfolio management are:

-

Benchmarking philosophy

-

Focus on total return

What are the Benefits of the Portfolio Optimizer?

The Portfolio Optimizer was developed to simplify your investment decision making and help you select an ideal mix of securities based on your benchmark and available funds. The tool allows you to see, in real time, how a mix of potential investments will influence your portfolio’s total return. Further, it mathematically allocates available funds to investments that provide the optimal risk and return combination for your credit union’s investment goals.

Most importantly, the Portfolio Optimizer helps you maximize investment returns, while adhering to acceptable risk levels as prescribed by your benchmark.

Read our Benchmarking White Paper

How does the Portfolio Optimizer Work?

QuantyPhi can perform a benchmarking study to determine the ideal benchmark for your credit union’s investment portfolio based on your unique balance sheet composition, investment goals, risk limits, and current market interest rates. Then, QuantyPhi’s team of investment experts will identify a population of securities specifically to fit your credit union’s investment policies and objectives that will help you align with your benchmark. Finally, using the Portfolio Optimizer, QuantyPhi can instantly show you the ideal way to allocate your available investment dollars in the most efficient manner to reach your benchmark goals.

The Portfolio Optimizer utilizes a Generalized Reduced Gradient (GRG) nonlinear solver algorithm to derive the ideal available funds allocation to optimize to the benchmark. It is a slope and derivative based algorithm that rapidly narrows potential solutions until an optimum solution is reached.

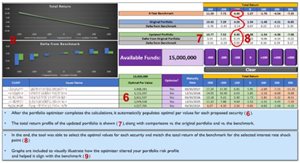

View an example of the tool below. The first image explains the various features and areas of focus for the Portfolio Optimizer and the second image details the results after the tool has run.

How will QuantyPhi help your credit union?

QuantyPhi will help your credit union create performance targets specific to your unique goals, and then help you develop and execute portfolio strategies that provide optimum levels of return with a given level of interest rate risk (IRR). Our performance optimization experts use high-powered technology that can analyze changing market data quickly, run “what-if” scenarios, and generate reports that help set appropriate, achievable benchmarks. At QuantyPhi, we have the technology to constantly crunch the numbers, so you don’t have to. We have the experts needed to interpret that mathematical data and show you how to meet/pass your benchmarks with flying colors. Our mission is to make your credit union a continual peak performer. Contact QuantyPhi at (414) 433-0176 to see the many ways we can help your credit union develop informed investment strategies and enhance your balance sheet management process.