This Time, Things will be Different

November 2019

By Daniel McIntyre, Vice President Investment Services at Corporate Central Credit Union and QuantyPhi

The story is compelling. Small Business Administration (SBA) securities come with a full faith and credit guarantee of the U.S. government. Dealer’s quoted yields are extremely attractive. Most have floating rate coupons offering protection from a rising interest rate scenario. Collectively these features often put SBAs at the top of the value list for portfolio managers.

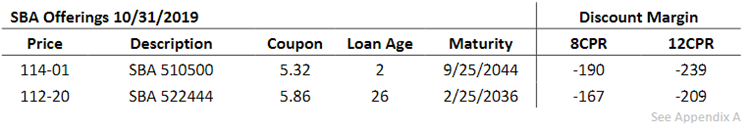

Two SBA pools offered on October 31, 2019 are shown below. Both come with double digit premiums, a common feature seen in the SBA market. However, using the dealer’s prepayment projections of 8 to 12 CPRi they generate eye catching yields. The discount margins shown translate to current yields of 2.36% to 2.66% even using the faster prepayment speeds suggested by the dealer. Those yields will grab your attention when five-year Treasuries are sitting below 1.75%, ten-year notes at 1.93%, and thirty-year bonds at 2.41%.

In addition to the high quoted yields, SBAs also provide protection against rising interest rates. Their floating rate coupons are indexed to the Prime rate and adjust on a quarterly basis. The coupon changes are not subject to any periodic or lifetime rate caps.

With the spotlight shining on the government guarantee, yield quotes well above alternatives, and protection from rising rates, it is easily understood why credit unions have been attracted to SBAs. Unfortunately, when the spotlight is turned off and the houselights go on, SBAs can take on a much different look. The villain in the SBA story should be no surprise. Given the premiums that come with these bonds, accelerated prepayment rates can inflict significant damage. Despite double digit premiums being commonplace, higher prepayment rates are largely ignored by buyers.

Our recommendation is always to look at a wide array of possibilities before putting any security into your portfolio. Understand the consequences if rates zig when you expect them to zag. Always ask, “What could possibly go wrong?” In the case of SBAs, a combination of fast prepayment speeds and premium dollar prices provide an easy answer to that question.

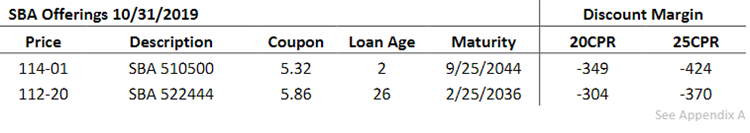

With street projections of 8 to 12 CPR prepayment speeds, our initial test would be to double them to understand the effect it would have as they sat in the portfolio. The table below shows the adjusted discount margins on the two examples if prepayment speeds come in at 20 and 25 CPR.

Most portfolio managers would avoid locking in a spread lower than the fed funds rate. Now that we understand the consequences, we need to determine if speeds two to three times dealer projections are possible. In the case of SBAs, a quick look at historic prepayments moves the chance of these accelerated prepayment rates from possible to probable.

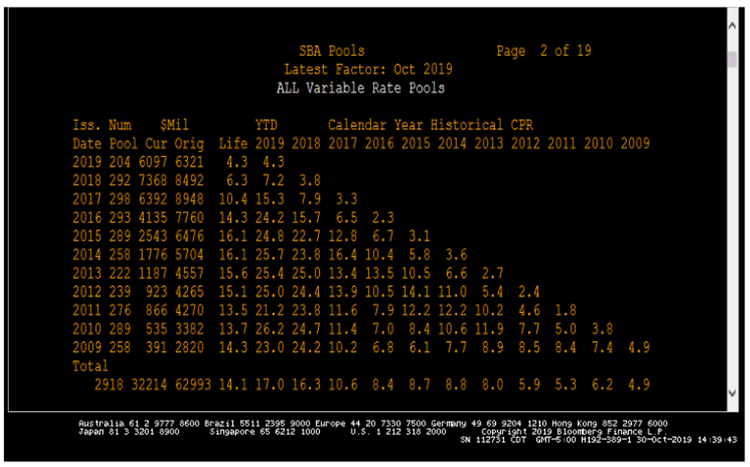

The table below shows the history of SBA prepayment rates. While an 8 to 12 CPR rate might be appropriate for the initial two years of life, once a pool crosses the two-year age threshold, speeds of 20 to 25 CPR are commonplace.

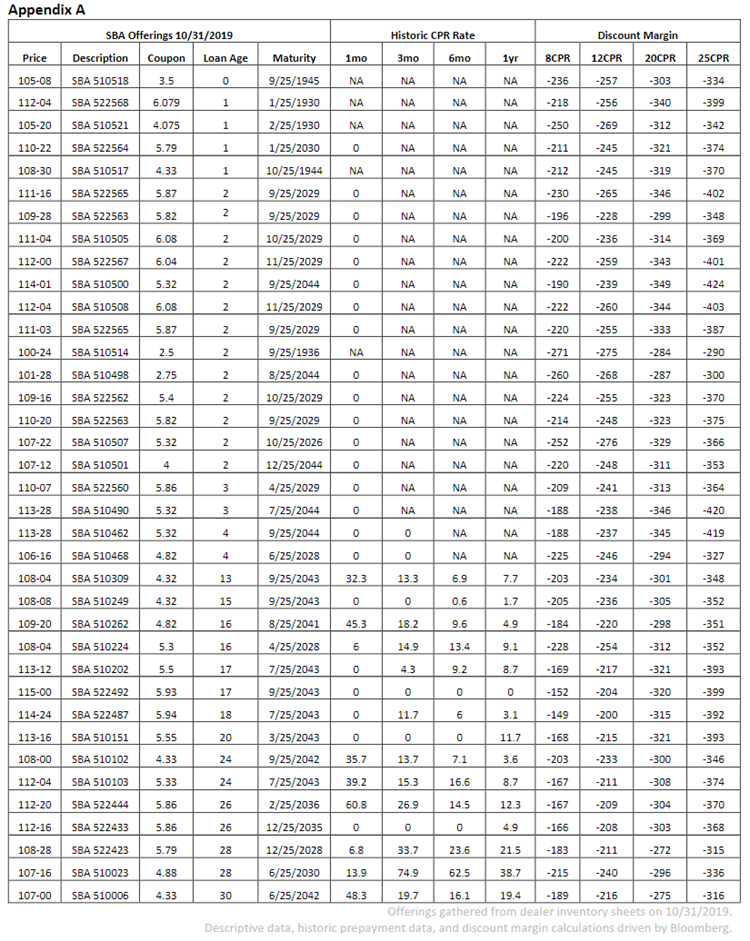

In Appendix A, you will see three dozen SBA pools offered on October 30, 2019, including the two used in our example. The table shows the offering price, prepayment history, and discount margins run at prepayment speeds of 8, 12, 20, and 25 CPR. Across the board we see attractive results in the 8 to 12 CPR range. A 20 CPR rate brings most of the paper back to discount margin on top of fed funds (Prime –300) while 25 CPR pushed returns well through fed funds.

The historic prepayment experience is in line with that of the SBA universe we looked at earlier. Those pools less than a year old show no prepayments. The underlying loans are qualified small businesses. It should not be surprising that most, if not all, survive the first year. In year two we begin to see some acceleration. Again, in line with SBA historical speeds. Once loan age reaches two years, prepayment speeds continued to display similar experiences to the SBA universe’s history with all but one pool showing significant prepayment acceleration.

This brings us to the million-dollar question: why is the dealer community still using 8 to 12 CPR speeds when showing SBA paper? We don’t have an answer. What we can tell you is that looking at SBA pools, the 20 to 25 CPR rates are representative of where most pools are paying currently, not a look to measure consequences of a prepayment acceleration. Much like the future course of interest rates, we cannot tell you what prepayment speeds will be going forward. We always recommend looking at the likely results under a wide range of scenarios to see how well a security will fit into portfolio. A good starting point would be to look at it under current rates and prepayment experience. If something must change in order to make sense, it’s generally best to avoid it. The street mantra of “this time, things will be different,” rarely turns out well.

*Securities offered through Concourse Financial Group Securities, Inc. (CFGS), Member FINRA/SIPC. Advisory services offered through Pershing Advisor Solutions, a DBA for CFGS, a Registered Investment Advisor. QuantyPhi, LLC. is independent of CFGS.

**Securities offered through Concourse Financial Group Securities, Inc. (CFGS), Member FINRA/SIPC. QuantyPhi, LLC. is independent of CFGS. Check the background of your financial professional on FINRA’s BrokerCheck